How the CARES Act Affects Unemployment Benefits for Individuals

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) which, among other things, provides additional unemployment benefits to employees who have been affected by the COVID-19 virus. The CARES Act includes provisions which provide unemployment benefits to individuals in a variety of situations, including provisions for self-employed individuals, individuals who have exhausted their unemployment benefits, and those for which unemployment benefits would not otherwise be available. Each of these provisions entitle individuals the right to receive the additional $600 benefit from the Federal government.

A brief overview of the three new unemployment benefit provisions, and the criteria for each, are as follows:

- Emergency Increase in Unemployment Compensation Benefits – For individuals who qualify for regular State unemployment benefits, the CARES Act provides that States will make payments of regular unemployment benefits to individuals, calculated pursuant to State law, plus an additional amount of $600 (the “Federal Pandemic Unemployment Compensation” amount). This additional benefit is available until July 31, 2020.

- Pandemic Unemployment Assistance – These benefits are available to “covered individuals” who are (1) not eligible for regular unemployment benefits, extended unemployment benefits under State or Federal law, or Pandemic Emergency Unemployment Compensation (as discussed below), and who self-certify that he or she is available to work, except he or she is “unemployed, partially unemployed, or unable or unavailable to work” because:

- the individual has been diagnosed with COVID-19 or is experiencing symptoms of the virus and is seeking medical diagnosis;

- a member of the individual’s family has been diagnosed with COVID-19;

- individual is providing care for a family member who has been diagnosed with COVID-19;

- a child, for which the individual has primary caregiving responsibility, is unable to attend school or daycare as a direct result of the COVID-19 public health emergency and such school or daycare is required for the individual to work;

- the individual is unable to go to work because of a quarantine imposed;

- the individual is unable to go to work because his or her doctor has advised the individual to self-quarantine;

- the individual was scheduled to start employment, but is unable to go to the job because of the COVID-19 public health emergency;

- the individual has become the head of the household because the head of the household has died as a result of COVID-19;

- the individual has to quit his or her job as a result of COVID-19;

- the individual’s place of employment is closed as a result of COVID-19; or

- the individual meets any additional criteria established by the Secretary for unemployment assistance.

Examples of a “covered individual” under this section include an individual who is self-employed, does not have sufficient work history, or otherwise would not qualify for regular unemployment or extended benefits under State or Federal law. However, individuals who are able to work remotely or are receiving paid sick leave or other paid leave benefits, regardless if they satisfy a qualification above, are not “covered individuals” under this section.

A “covered individual” who is unemployed, partially unemployed, or unable to work, shall be entitled to (i) the weekly benefit amount he or she would receive under the State’s unemployment compensation laws (i.e. generally, in Nebraska, 50% of average weekly wages not to exceed $440); and the $600 Federal Pandemic Unemployment Compensation benefit.

A “covered individual” is entitled to these unemployment benefits for weeks of unemployment, partial unemployment, or inability to work caused by COVID-19 beginning on or after January 27, 2020 and ending on or before December 31, 2020, as long as the “covered individual’s” unemployment, partial unemployment, or inability to work because of COVID-19 continues during this time. In any event, the total number of weeks a “covered individual” can receive assistance shall not exceed 39 weeks. - Pandemic Emergency Unemployment Compensation – For individuals who have (i) exhausted all rights to regular unemployment benefits for a benefit year; (ii) have no right to regular unemployment compensation with respect to a week under State law; (iii) are not receiving compensation with respect to such week under the unemployment compensation law of Canada; and (iv) are able, available and actively seeking work, the CARES Act provides payments of Pandemic Emergency Unemployment Compensation.

The weekly benefit under this section is equal to (i) the amount of regular unemployment compensation payable to the individual during the individual’s benefit year under State law for a week of total unemployment; and (ii) $600 in Federal Pandemic Unemployment Compensation.

For those who file an application for benefits under this section, the State’s Secretary of Labor shall establish a Pandemic Emergency Unemployment Compensation Account in each individual’s name. The amount in the account shall be equal to 13 times the individual’s average weekly benefit amount, which includes the $600 Federal Pandemic Unemployment Compensation, and the weekly benefit shall be paid out of this account.

How Unemployment Benefits in Nebraska are Affected:

During the press conference on March 30, 2020, Governor Ricketts announced that Nebraska has entered into the necessary agreements with the Department of Labor to implement each one of the programs under the CARES Act. He stated that the Nebraska Department of Labor is working to implement software changes necessary to put each of these provisions into effect, but it may take 2 to 4 weeks for individuals to start receiving the Federal funds. He also said that individuals do not need to file an additional claim for the $600 Federal Pandemic Unemployment Compensation; it will be automatically added to the regular unemployment benefit amounts received.

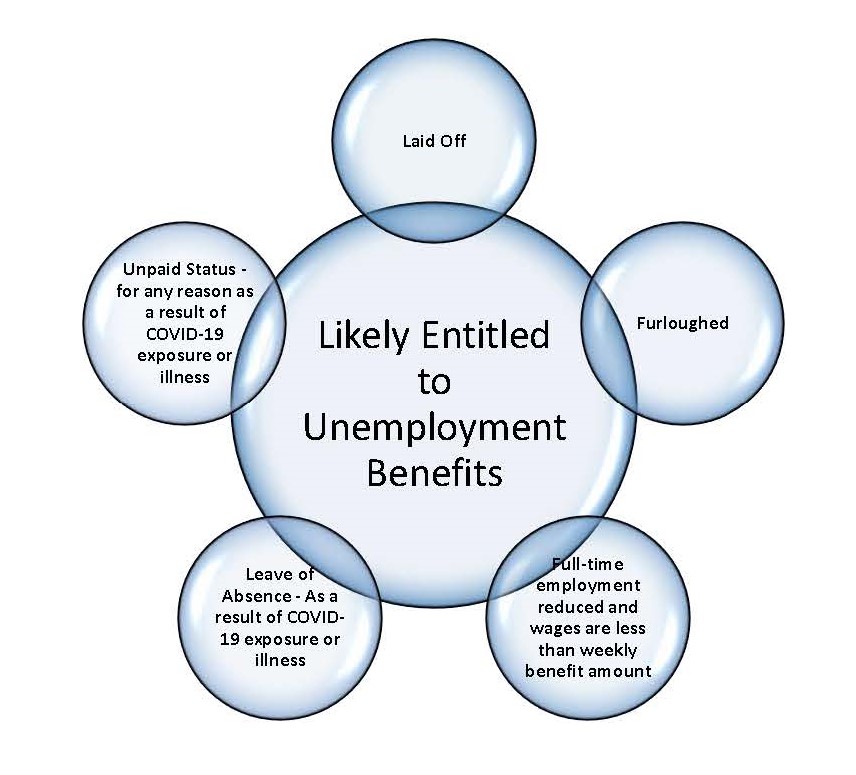

Who is Eligible for Unemployment Benefits in Nebraska:

It is important to note that the determination of eligibility for unemployment benefits is made by Nebraska’s Department of Labor, and the following chart is only a depiction of who is generally able to file for benefits. Other eligibility requirements, such as compensation thresholds and work history, must be satisfied in order to be eligible for benefits.

We are continuing to monitor changes and developments in unemployment benefits and will provide another update as soon as any guidance is published. If you have any questions or concerns, please contact a member of the Koley Jessen Employment Practice Group.

* The information contained in this document is provided for informational purposes only. It should not be construed as business, legal, accounting, tax, financial, investment or other advice on any matter and should not be relied upon for such.

The information in this document may not reflect the most current developments as the subject matter is extremely fluid and may change daily. The content and interpretation of the issues addressed herein is subject to revision. Koley Jessen, P.C., L.L.O. disclaims any and all liability with respect to actions taken or not taken based on any or all of the contents of this document to the fullest extent permitted by law. Do not act or refrain from acting upon the information contained in this document without seeking professional or other advice.