Qualified Opportunity Funds Summary – October 2018

New Internal Revenue Code Section 1400Z creates qualified opportunity funds and qualified opportunity zones. This program is designed to incentivize the reallocation of capital to designated low-income census tracts. It presents a potentially remarkable opportunity for taxpayers to defer and reduce capital gain and subsequently exclude the appreciation of a qualified opportunity fund investment from income.

Potential Benefits

- A realized capital gain that is timely reinvested in a qualified opportunity fund is deferred until the earlier of (i) the date that the qualified opportunity fund investment is sold or (ii) December 31, 2026

- The amount of the deferred capital gain ultimately recognized is reduced by up to 10% if the qualified opportunity fund interest is held for 5 years and by up to an additional 5% to a total of 15% if the qualified opportunity fund interest is held for 7 years

- This would, for example, allow a $10 million capital gain realized in 2018 to be taxed as an $8.5 million capital gain on December 31, 2026

- If held for 10 years, the ability to make a tax-free sale of the qualified opportunity fund interest (the original deferred capital gain would still be taxed, but only 85% of it)

Basic Statutory Requirements

- Capital gain realized from the sale of property to an unrelated party after December 31, 2017

- Reinvestment of the deferred capital gain in a qualified opportunity fund within 180 days of the sale or exchange

- The investment of at least 90% of the qualified opportunity fund’s assets in qualified opportunity zone property

Current Status of the Program

- Qualified opportunity zones (including 44 census tracts in Nebraska, 15 of which are in Douglas County) have been designated

- On October 19, 2018, the IRS issued eagerly anticipated proposed regulations, Revenue Ruling 2018-29, draft Form 8996, and draft Instructions for Form 8996

- The October 2018 guidance, while not answering all questions, appears to provide sufficient clarity for investors, business owners, real estate developers, and fund managers to confidently move forward with appropriate and carefully structured qualified opportunity fund projects

Qualified Opportunity Fund

- A qualified opportunity fund is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is located in an opportunity zone and that utilizes the investor’s capital gains from a prior investment for funding the qualified opportunity fund

- A qualified opportunity fund must:

- Be organized as a partnership or corporation for Federal income tax purposes;

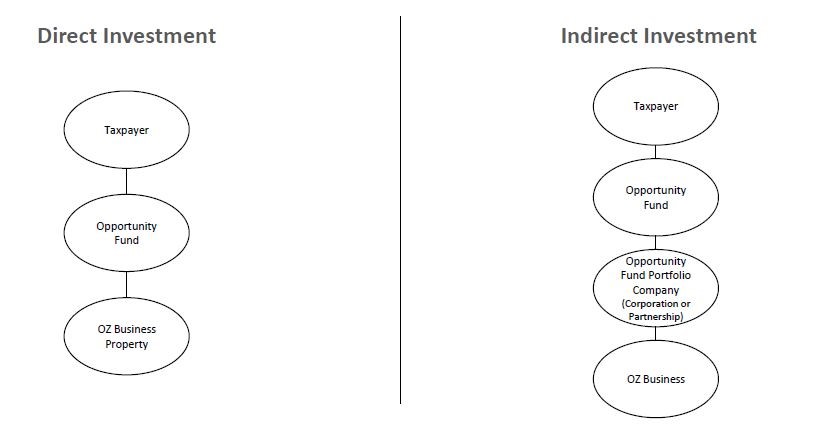

- Be organized to invest in qualified opportunity zone property, which is defined by Code Section 1400Z-2(d)(2) to include qualified opportunity zone partnership interests and stock (indirect investment through a portfolio company that owns an opportunity zone business) and qualified opportunity zone business property (direct investment); and

- Invest at least 90% of its assets, calculated as the average of two semiannual testing dates, in qualified opportunity zone property

- A qualified opportunity fund can have only one member or multiple members

- A qualified opportunity fund can be, but does not have to be, professionally managed

General Investment Structures

This content is made available for educational purposes only and to give you general information and a general understanding of the law, not to provide specific legal advice. By using this content, you understand there is no attorney-client relationship between you and the publisher. The content should not be used as a substitute for competent legal advice from a licensed professional attorney in your state.